Do Medicare Advantage Plans Cover Dental Services?

Original Medicare offers limited dental coverage, but Medicare Advantage Plans typically cover preventive and comprehensive dental services.

TABLE OF CONTENTS

- I. Do all Medicare Advantage Plans come with dental coverage?

- II. How do you find a Medicare Advantage Plan with dental coverage?

- III. What are your options if your Medicare Advantage Plan doesn’t offer dental coverage?

- IV. What services do Medicare Advantage dental plans cover?

- V. What costs are associated with Medicare Advantage dental coverage?

- VI. Sources

What you should know

| 1. Original Medicare parts A and B don’t offer dental coverage outside of the limited coverage that you get under Part A. You must enroll into a Medicare Advantage Plan or a stand-alone dental plan. | 2. Medicare Advantage Plans with dental coverage don’t have a waiting period before you can use the dental plan. |

| 3. Most plans cover both preventive and comprehensive dental services. | 4. In most cases, there is an annual allowance offered to offset the cost of dentures or any other comprehensive service. |

Do all Medicare Advantage Plans come with dental coverage?

All Medicare Advantage Plans have dental coverage. Medicare Advantage Plans have to cover everything that Original Medicare covers. Dental is very limited when you are only covered by Original Medicare. However, if you have a Medicare Advantage Plan, there could be some added benefits.

For example, you may be offered an annual allowance that can be used on your dental coverage for certain comprehensive services. Typically, cleanings and X-rays are covered as part of preventive services and normally include two cleanings including X-rays during the visit annually.

The best part about dental coverage on the Medicare Advantage Plan is that it is all-inclusive with the plan, and there is no waiting period. Even if the Medicare Advantage doesn’t have a monthly premium, it’ll still offer dental coverage in most cases.

How do you find a Medicare Advantage Plan with dental coverage?

Finding a Medicare Advantage Plan that offers dental coverage isn’t difficult. Most carriers market their dental coverage upfront. If not, and you’re searching for plans with dental coverage, a good place to start is the official Medicare website, Medicare.gov.

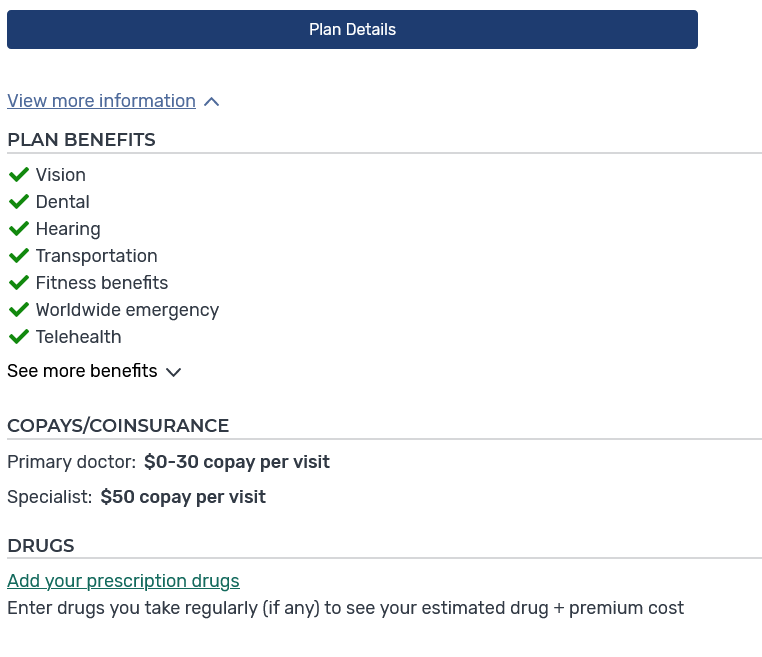

Click “View more information” on Medicare.gov to see plan details.

Medicare.gov is a terrific resource to use when searching for medication costs and other benefits that you need. Medicare.gov will show some of the ancillary benefits that are offered on each plan listed. If you’d like to explore the benefits, you can access each specific plan. Upon doing so, you’ll be able to see the highlights of the benefits, specifically the dental benefits.

What are your options if your Medicare Advantage Plan doesn’t offer dental coverage?

If your Medicare Advantage Plan doesn’t offer dental coverage, you have a few options.

- You can change your Medicare Advantage Plan to a plan that offers dental coverage.

- You also have the option of purchasing a stand-alone dental plan.

The disadvantage to purchasing a standalone dental plan is that it may have a waiting period before you can access the full benefits of the plan.

What services do Medicare Advantage dental plans cover?

Medicare Advantage dental plans are basically universal across the board. The benefits are normally the same. However the annual allowance may differ by plan. Below, you can look at the benefits that typically are included in a Medicare Advantage dental plan and coverage:

- Preventive services

- Routine oral exam

- Nonroutine services

- Cleanings

- X-rays

- Comprehensive services like dentures or root canals

- Fluoride treatment

- Annual allowance like preventive and comprehensive treatments

What costs are associated with Medicare Advantage dental coverage?

In most cases, you won’t have to pay a copay for dental coverage. The preventive services won’t cost anything normally. If your preventive benefit is included in the allowance and you exhaust your allowance during the year, you may have to pay for any additional preventive services. If you decide to purchase dentures with the allowance, you are responsible for the additional funds after the allowance has been exhausted. Lastly, if you have any non-routine services done, you have to pay a copay for those services.

Medicare dental coverage costs

| Increased plan costs

If you decide to enroll into a Medicare Advantage Plan because of the dental coverage, the plan premium won’t change because of that coverage. If you decide to enroll into an Medicare Advantage Plan for $0, the plan won’t increase based on the dental coverage. |

| Copay costs

Unless you have used the full amount of your annual allowance or receive nonroutine services, you shouldn’t have any payment responsibilities. |

| Services that are not covered

Each plan is different, you’ll have to use the Evidence of Coverage (EOC) for any specific plan to find out what the exclusions are. It’s a best practice to explore the EOC to see each benefit offered in full detail. |

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelor’s degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

He’s passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

LeRon Moore has guided Medicare beneficiaries and their families as a Medicare professional since 2007. First as a Medicare provider enrollment specialist and now a Medicare account executive, Moore works directly with Medicare beneficiaries to ensure they understand Medicare and Medicare Advantage Plans.

Moore holds a bachelor’s degree from Southern New Hampshire University and is A+ Certified with a Medical Records Clerk Certification and Medical Terminology Certification from Midlands Technical College.

He’s passionate about educating, informing, and resolving issues concerning Medicare and Medicare Advantage Plans, and considers it imperative that he does all he can to educate and inform the senior community as much as possible about Medicare.

Sources

- Medicare.gov: Dental Services | Last Accessed July 2024

- KFF: Medicare and Dental Coverage: A Closer Look | Last Accessed July 2024