Highmark Health Insurance Review

Find out if Highmark health insurance meets your needs.

TABLE OF CONTENTS

Highmark offers numerous policies to fit most budgets and health needs, but its lack of coverage for out-of-network providers limits flexibility.

Overall rating: 4.1

Highmark is a leading health insurance organization and the fourth-largest independent licensee of the Blue Cross Blue Shield Association, serving more than 6 million customers in Pennsylvania, Delaware, New York, and West Virginia. It has an extensive provider network of more than 90,000 doctors. Highmark backs up its health insurance plans with community initiatives, such as Highmark Walk for Healthy Community and the Highmark Caring Place.

Highmark Health Insurance Overview

| Company founded | 1996 |

| Coverage area |

|

| A.M. Best rating | A |

| BBB rating | A- |

| NCQA accreditation | Yes |

| NCQA rating | 3.5 to 4 |

| Plans available |

|

| Provider network |

|

Is Highmark a Good Health Insurance Provider?

| What we like about Highmark health insurance plans: | The drawbacks of Highmark health insurance plans: |

|---|---|

|

|

What Do Highmark Health Insurance Plans Cover?

Highmark offers a variety of health insurance plans that may meet your health needs and budget:

- CHIP

- Dental

- Individual and family plans

- Medicare Advantage Plans and Medicare Supplement Insurance

- Travel

- Vision

Highmark Health Insurance Plan Options

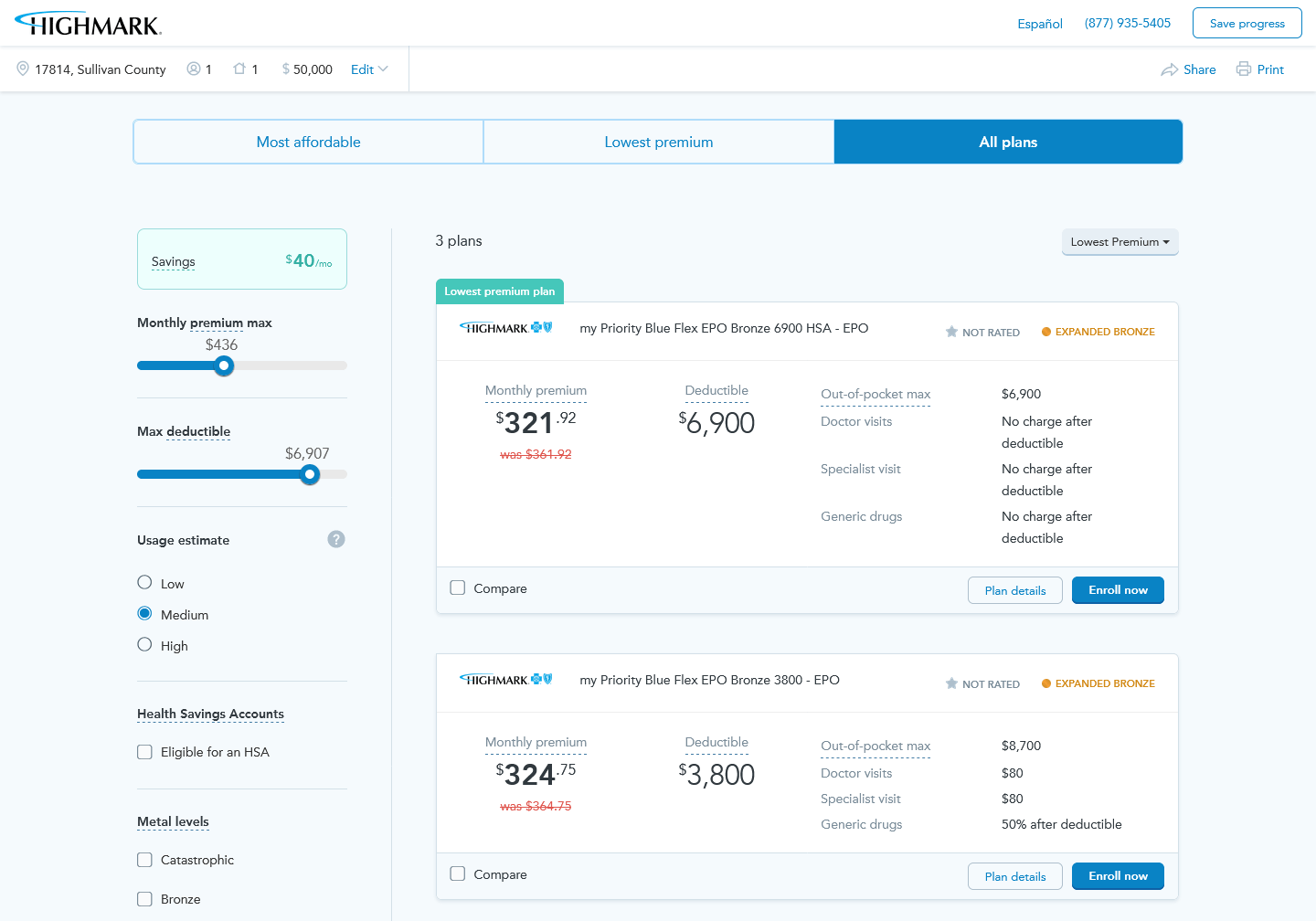

Highmark has a range of health insurance plans at varying price points. Monthly premiums range between $383 and $669, but your rate may be lower if you qualify for an income-based subsidy. All of Highmark’s health insurance plans are EPOs, so you’re required to obtain care from health care providers within the plan’s network.

Compare some of Highmark’s top health insurance plan options:

Highmark Health Insurance Plan Options

| Plan name | Monthly premium | Annual deductible | Office visits | Annual maximum out-of-pocket cost |

| Shared Cost Blue EPO Bronze 3800 – EPO | $383 | $3,800 | Doctor visit: $60

Specialist visit: 50% coinsurance after deductible |

$8,500 |

| Health Savings Embedded Blue EPO Bronze 6900 HSA – EPO | $387 | $6,900 | No charge after deductible | $6,900 |

| Shared Cost Blue EPO Bronze 3800 + Adult Dental and Vision – EPO | $416 | $3,800 | Doctor visit: $60

Specialist visit: 50% coinsurance after deductible |

$8,500 |

| Health Savings Embedded Blue EPO Silver 3450 HSA – EPO | $499 | $3,450 | Doctor visit: $70 after deductible

Specialist visit: $70 after deductible |

$6,900 |

| Shared Cost Blue EPO Platinum 0 + Adult Dental and Vision – EPO | $669 | $0 | Doctor visit: $5

Specialist visit: $5 |

$5,000 |

*Based on pricing for a nonsmoking 35-year-old female in Dover, Delaware.

How Is Highmark Rated?

Trusted ratings and reviews can help you understand how an insurer’s plans stack up against the competition. See how we rated Highmark.

Overall rating: 4.1

| Financial strength rating: 4.5 |

Customer satisfaction rating: 4 |

Value rating: 4 |

Coverage rating: 4 |

Financial strength: 4.5/5 stars

Highmark’s financial strength rating indicates whether the company has sufficient assets to fulfill its financial obligations to its customers. A.M. Best rates Highmark an A-, which indicates financial stability to pay claims.

Customer satisfaction: 4/5 stars

Highmark’s customer satisfaction rating is based on customer feedback from the Better Business Bureau (BBB), the National Committee for Quality Assurance (NCQA), and Consumer Affairs.

Highmark is rated A- by the BBB. In the past three years, the insurance provider has closed 44 customer complaints. Thirteen of those complaints were closed within the past 12 months.

The NCQA gives Highmark’s plans overall ratings of 3.5 and 4.0. Across the three categories, including consumer satisfaction, prevention, and treatment, most plans have scores of 3.0 and 3.5, indicating average performance.

Consumer Affairs gives Highmark 2.5 out of 5 stars based on 33 ratings.

Value: 4/5 stars

Highmark’s overall value rating is based on the benefits its plans provide compared to benefits available from other health insurance plans at comparable price points. Some costs that are considered include monthly premiums, copays, and coinsurance, maximum out-of-pocket limits, and annual deductibles.

Coverage: 4/5 stars

Highmark’s coverage rating indicates the range of options customers have about the types of plans available, in-network providers, and coverage options.

Tammy Burns is an experienced health insurance advisor. She is Affordable Care Act (ACA)-certified for health insurance and other ancillary, life, and annuity products.

She’s always been driven by a desire to help people, spending more than 25 years as a practicing nurse in hospitals, private doctors’ offices, home health, and hospice. As a nurse, Burns supported patients filing insurance claims with Medicare, Medicaid, and private insurance companies as well as responding to billing questions from confused patients.

Seeing firsthand how unsuspecting patients are frequently confused by an overly complex system they don’t understand led Burns to become an insurance agent and health care consultant, now helping people understand the medical system. Since becoming an agent, she has worked with some of the largest and most reputable insurance carriers and agencies in the nation, and she has built a large and loyal clientele by way of her commitment to transparency and personalized service.

Tammy Burns is an experienced health insurance advisor. She is Affordable Care Act (ACA)-certified for health insurance and other ancillary, life, and annuity products.

She’s always been driven by a desire to help people, spending more than 25 years as a practicing nurse in hospitals, private doctors’ offices, home health, and hospice. As a nurse, Burns supported patients filing insurance claims with Medicare, Medicaid, and private insurance companies as well as responding to billing questions from confused patients.

Seeing firsthand how unsuspecting patients are frequently confused by an overly complex system they don’t understand led Burns to become an insurance agent and health care consultant, now helping people understand the medical system. Since becoming an agent, she has worked with some of the largest and most reputable insurance carriers and agencies in the nation, and she has built a large and loyal clientele by way of her commitment to transparency and personalized service.

Sources

- AM Best Highmark Rating | Last accessed August 2021

- Better Business Bureau | Highmark Blue Cross Blue Shield | Last accessed August 2021

- Consumer Affairs | Highmark | Last accessed August 2021

- Healthcare.gov | Exclusive Provider Organization (EPO) Plan | Last accessed August 2021

- Highmark | Our Story | Last accessed August 2021

- Highmark | Signature Programs | Last accessed August 2021

- Highmark | Easily find an affordable health plan | Last accessed August 2021

- National Committee for Quality Assurance | NCQA Health Insurance Plan Ratings 2019-2020 | Last accessed August 2021